Some NGOs, non-profits and charitable institutions go to great lengths to improve the lives of the marginalised and underprivileged. Others work to benefit the environment.

In Malaysia, the government offers tax deductibles to help support the great work that these organisations do. It's also an incentive for you to be more generous.

Tax deductibles are just one of the benefits of donating to charity. Here's how they work in Malaysia.

1. Tax-deductibles reduce the amount you have to pay the government

Image Credit: iMoney

A part of your income – from a business, employment or even royalties – is taxable to the government.

Essentially, taxable income is your total annual income minus all the tax exemptions, tax deductibles and tax reliefs that you're entitled to.

Usually, paying your taxes leaves you with less money than you'd otherwise have. This is one of the reasons why some people end up evading their taxes.

Image Credit: iMoney

However, having a clear understanding about tax deductibles can help lower the amount you pay the government.

Simply put, when you donate to a charitable organisation, the government recognises your generosity. They deduct a certain amount from your taxable income that results in you paying less tax.

But here's the catch.

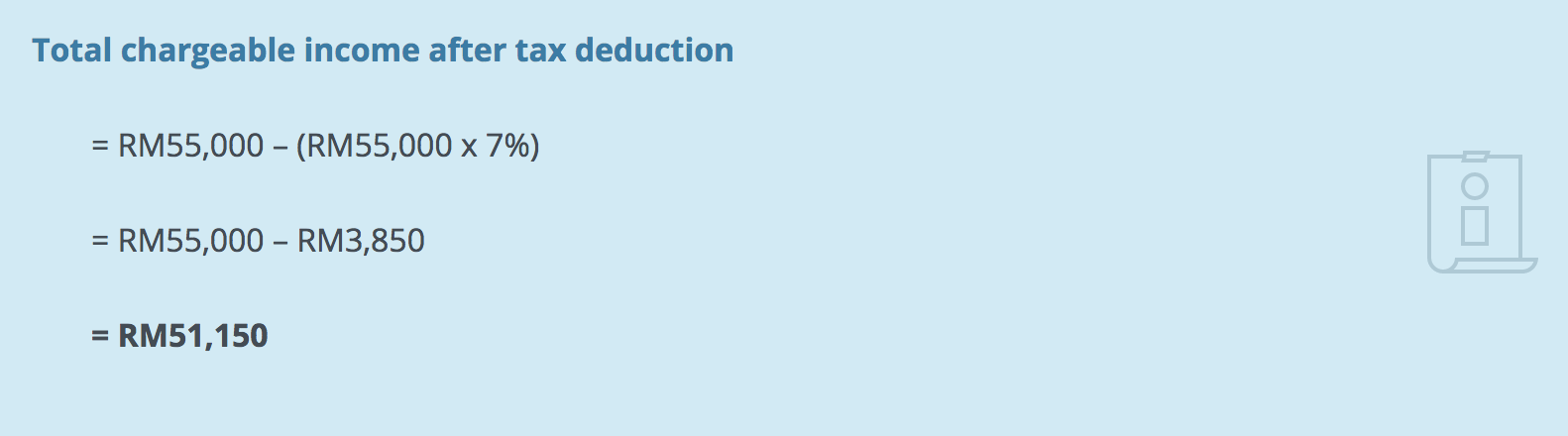

2. You can only claim a tax deduction up to 7% of your annual salary.

The Malaysian government caps it off at 7% of your annual salary. For example, if you earn RM55,000 annually, the maximum amount that's deductible is RM3,850.

Image Credit: iMoney

So if you donate RM4,000 to a charity, only RM3,850 is deducted from the total taxable income. This maximum limit ensures that you don’t pay any less to the government.

Therefore, the 7% tax deduction varies depending on one’s annual income. In Malaysia, companies can claim up to 10% of tax deduction.

Also on Jireh's Hope: 10 Interesting Ideas You Probably Did Not Know About Sustainable Fashion

3. Only donations made to approved institutions are eligible

Image Credit: Love & Respect Transformation

Donations are only tax deductible if they’re made to a government approved organisation. Tax deductibles don't apply to donations you make to an individual.

This ensures the legitimacy of charitable organisations, and helps prevent fraudulent behaviour.

Donations made to organisations like Mercy Malaysia, UNICEF Malaysia, and Malaysian Care are tax deductible.

Also, donating to such government approved organisations will help put your mind at ease. Furthermore, it gives you an assurance that your donations would be utilised ethically.

4. Tax deductibles are also valid for certain non-monetary donations too

Image Credit: Hin Hua High School

According to iMoney, this covers contributions like property, medical equipment and various facilities.

For non-monetary donations, you have to estimate the fair market value of the item. This has to be an appropriate value depending on its description, condition and prices.

Businesses usually hire experts to analyse and provide a written appraisal for such items. Donating appreciating assets like property are more profitable than depreciating assets like transportation or food.

5. You need to present valid proof when you're claiming your tax deductibles

Image Credit: Shutterstock

According to Forbes, receipts should include details like your full name, the date, the amount and the organisation that received the donation. When filing for tax deductions, the government requires such information to avoid misdemeanours.

To quote Johann Wolfgang, "You can easily judge the character of a man by how he treats those who can do nothing for him".

Charitable tax deductions are important as the wealthy contribute their fair share toward society. In the end, it's not how much you give, but how willing you are to give.

*Feature Image Credit: OTTA Project